10 Simple Techniques For Npo Registration

Wiki Article

Rumored Buzz on Non Profit Organization Examples

Table of ContentsSome Known Details About Non Profit Organization Examples Getting My Irs Nonprofit Search To Work501 C Fundamentals ExplainedThe smart Trick of Non Profit Organizations Near Me That Nobody is Talking AboutThe 10-Minute Rule for Nonprofits Near MeUnknown Facts About 501c3 Organization

While it is risk-free to claim that most charitable organizations are honorable, organizations can absolutely experience a few of the exact same corruption that exists in the for-profit business world - npo registration. The Post discovered that, in between 2008 and 2012, even more than 1,000 not-for-profit organizations examined a box on their internal revenue service Type 990, the tax obligation return type for exempt organizations, that they had experienced a "diversion" of assets, suggesting embezzlement or other fraudulence.4 million from purchases linked to a sham organization started by a former assistant vice president at the company. One more example is Georgetown University, that endured a considerable loss by a manager that paid himself $390,000 in additional settlement from a secret financial institution account formerly unknown to the university. According to federal government auditors, these stories are all too usual, and act as sign of things to come for those that venture to create as well as operate a charitable company.

In the instance of the HMOs, while their "promotion of wellness for the benefit of the neighborhood" was deemed a philanthropic objective, the court established they did not operate largely to benefit the area by giving wellness services "plus" something extra to profit the area. Therefore, the cancellation of their excluded status was maintained.

The smart Trick of Non Profit Organizations Near Me That Nobody is Discussing

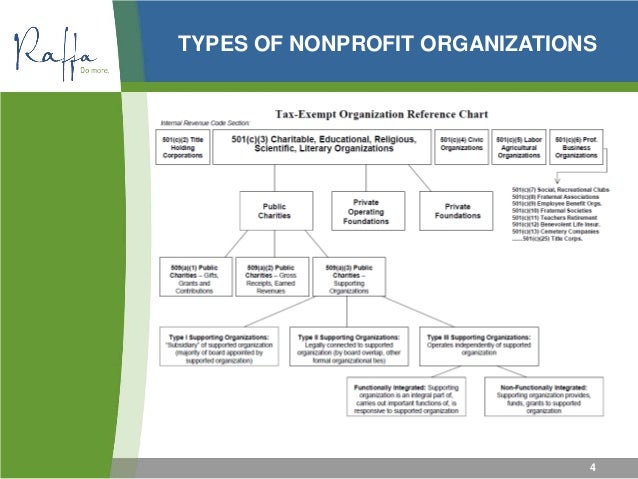

Additionally, there was an "overriding government passion" in banning racial discrimination that exceeded the institution's right to free exercise of faith in this fashion. 501(c)( 5) Organizations are labor unions and farming as well as horticultural associations. Labor unions are companies that develop when employees associate to participate in collective bargaining with an employer regarding to wages and also advantages.By contrast, 501(c)( 10) companies do not attend to payment of insurance coverage benefits to its members, and so might arrange with an insurance policy business to offer optional insurance policy without jeopardizing its tax-exempt status.Credit unions as well as various other mutual financial organizations are identified under 501(c)( 14) of the internal revenue service code, as well as, as component of the financial sector, are greatly managed.

501 C Can Be Fun For Everyone

Getty Images/Halfpoint If you're considering beginning a nonprofit company, you'll intend to comprehend the different types of not-for-profit classifications. Each designation has their own demands and also compliances. Right here are the sorts of nonprofit classifications to aid you determine which is appropriate for your organization. What is a not-for-profit? A not-for-profit is a company running to enhance a social reason or sustain a common mission.Offers payment or insurance to their members upon health issues or other stressful life occasions. Membership needs to be within the same work environment or union. Use subscription dues to sustain outdoors causes without settlement to participants. Set up and manage educators' retired life funds.: Exist solely to aid in the interment procedures for members.

g., online), even if the not-for-profit does not straight get contributions from that state. Furthermore, the internal revenue service needs disclosure of all states in which a nonprofit is registered on Type 990 if straight from the source the nonprofit has earnings of greater than $25,000 annually. Charges for failure to register can consist of being forced to return donations or encountering criminal fees.

A Biased View of Irs Nonprofit Search

com can aid you in signing up in those states in which you plan to get donations. A nonprofit company that receives substantial parts of its earnings either from governmental resources or from straight contributions from the basic public might certify as a publicly supported organization under area 509(a) of the Internal Earnings Code.

Due to the complexity of the regulations and also policies regulating designation as a publicly supported company, integrate. A lot of people or teams create not-for-profit firms in the state in which they will largely operate.

A nonprofit company with business locations in multiple states might develop in a single state, after that register to do company in other states. This indicates that not-for-profit firms must officially sign up, submit annual reports, and also pay annual charges in every state in which they perform organization. State legislations need all not-for-profit companies to keep a registered address with the Assistant of State in each state where they work.

Unknown Facts About Nonprofits Near Me

For instance, area 501(c)( 3) charitable organizations may not intervene in political projects or conduct substantial lobbying activities. Get in touch with a lawyer for even more specific details concerning your company. Some states only need one director, yet most of states need a minimum of 3 directors.

A company that serves some public objective as well as for that reason appreciates unique treatment under the legislation. Nonprofit firms, unlike their name, can make an earnings yet can not be created largely for profit-making. When it home comes to your organization structure, have you considered arranging your endeavor as a nonprofit corporation? Unlike a for-profit service, a nonprofit might be qualified for specific benefits, such as sales, building as well as earnings tax obligation exemptions at the state degree (501 c).

9 Easy Facts About 501 C Described

With a nonprofit, any cash that's left after the company has actually paid its costs is put back into the company. Some kinds of nonprofits can receive payments that are tax deductible to the individual that contributes to the organization.Report this wiki page